Exploring the Retail Revolution: Key Promotion Trends in 2023

The retail sector experienced a huge shift in 2023 because of changing consumer behavior, market dynamics, and technology changes. In a broad definition, this resulted in several key trends.

Digital Media's Rise to Prominence

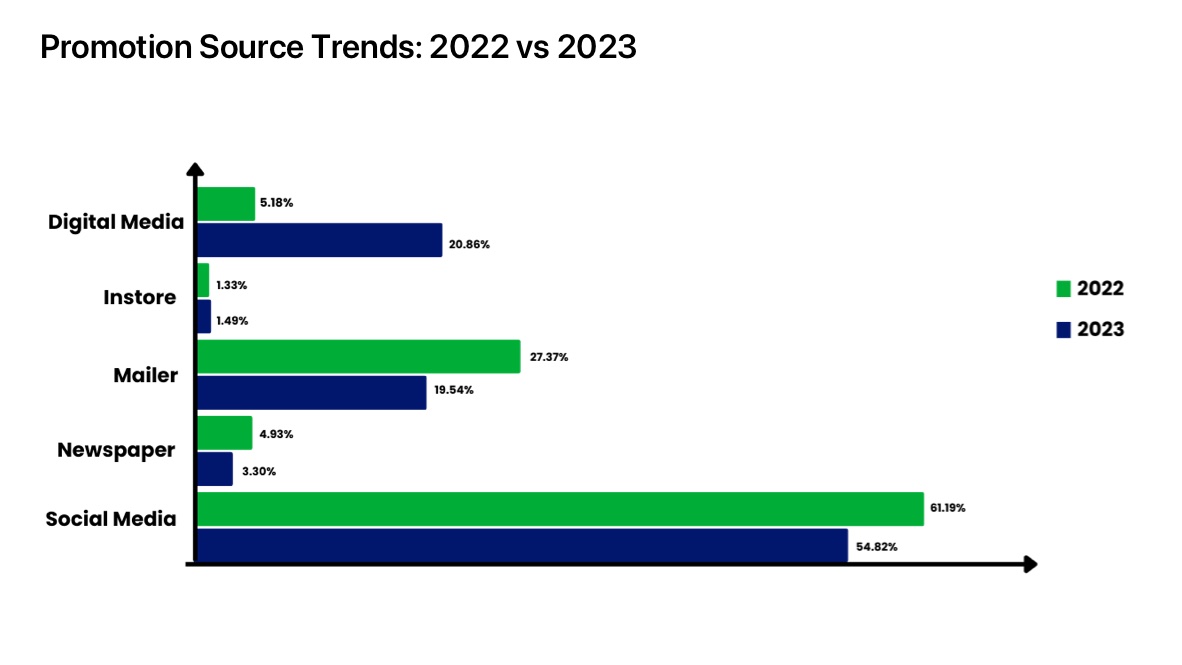

In recent times, we've seen a dramatic uptick in digital media promotions, skyrocketing from a mere 5.18% in 2022 to an impressive 20.86% in 2023. Household names like Watsons and Guardian have made the strategic leap to digital platforms, turning their backs on old-school tactics such as mailers and print ads. This isn't just a trend; it's a deep-seated shift in the business-consumer dynamic, showcasing a turn towards more targeted, wallet-friendly, and eco-conscious ways of reaching out to shoppers.

The Digital Shift: Online Information Takes the Lead

The surge in digital media isn't happening in a vacuum. Our collective turn towards the internet as the go-to for news, updates, and the lowdown on products has been a game-changer. Suppliers and retailers are quickly catching on, tailoring their strategies to meet us where we spend a considerable chunk of our time: online. This move isn't just about spreading their message further; it's about connecting with us on a more personal level.

Source: MailerTrack

Source: MailerTrackCategory and Department Insights

Health & Beauty Department

Rising Digital Media Promotions in Health & Beauty Department

In the health and beauty department, a marked shift towards digital media promotions is unfolding. Traditional methods are being left behind, with retailers such as Watsons and Guardian transitioning from paper-based mailers to dynamic online campaigns, significantly enhancing digital engagement.

Household Department

What Factors Contributed to the decline in Promotional Activities across Household Categories in 2023

In 2023, the Household Department experienced a broad decrease in promotional efforts across all categories. Notable declines were recorded in Detergent (13%), Dishwashing Agent (17%), and Multipurpose Cleaner (43%), while the Liquid Cleanser category witnessed a 6% increase. This downturn in promotional activities may be indicative of a shift in consumer priorities post-pandemic, leading to altered demand patterns for household items. Consequently, suppliers and retailers in this sector are advised to reassess their marketing strategies and product assortments to better correspond with these shifting consumer preferences.

Grocery Department

How did promotional trends for essential items such as rice and oil unfold in 2023?

The promotional landscape for essential staples like rice and oil experienced diverging trends. While promotions increased in the oil category, the rice category saw a decrease. This decline was primarily attributed to external factors, such as geopolitical tensions and currency fluctuations, which resulted in a surge in import prices on 1 September 2023 (New Straits Times, 2023). Consequently, suppliers and retailers were compelled to make strategic adjustments to ensure a balance between availability and profit margins.

Chilled & Frozen Department

Analysing Promotional Trends in the Chilled & Frozen Department for 2023

In the Chilled & Frozen department, promotions experienced a decline across all categories, particularly notable in the frozen food category (11%). Despite an initial increase in promotions during the first half of 2023, particularly in March, likely attributed to Ramadan promotions, there was a subsequent decrease in promotions for the remainder of the year compared to 2022.

Looking Ahead to the SST Increase: Adapting to Tax Changes

The anticipated increase in the Sales and Services Tax (SST) from 6% to 8% in March 2024 is expected to impact costs. Although the increase does not directly impact certain sectors like food and beverage or telecommunications, it affects logistics and other services, potentially leading to higher costs (FMT Business, 2023). These elevated costs will likely be passed on to consumers indirectly.

Suppliers must delicately balance costs and profits to maximize returns, particularly amidst the phenomenon of "shrinkflation," as the projected inflation rate for this year is anticipated to range between 2.6% and 3.1%, compared to 2.5% to 2.7% for 2023 (The Star, 2024).

In conclusion, the retail and promotional landscape of 2023 demonstrated the dynamic interplay of evolving consumer behaviors, economic factors, and external pressures such as currency fluctuations and geopolitical tensions. It highlighted the necessity for adaptability, innovation, and a nuanced understanding of market conditions.

Staying attuned to trends across different product categories, regional variations, and adapting to changes such as tax increases are crucial for ongoing success in the retail sector. The shift towards digital media, changing consumer preferences, and strategic responses to upcoming tax changes are all vital elements in navigating the dynamic retail environment of 2023 and beyond.

Don't Miss the Full Analysis

Download the complete report and arm yourself with the intelligence you need to stay ahead of the curve.

Don't miss your opportunity to gain a competitive edge.