The Big Picture: Declining Trends in Promotions

The first half of 2023 brought a slight downturn in promotional features, declining by 3% compared to the same period last year. The most significant contributors to this decline were the Pharmacy Channel and Range Promotions, both of which showed noticeable reductions.

The Chinese New Year Spike and The February Slump

Promotions in the first two months of the year presented a curious roller-coaster. A spike in January, attributed to the Chinese New Year, was followed by a significant slump in February. This pattern was consistent with the previous year's trends.

Source: MailerTrack Jan-Jun 2023 vs 2022, Mailer, Newspaper, In-Store, Social Media & Digital Media Excluding Regional Data

Source: MailerTrack Jan-Jun 2023 vs 2022, Mailer, Newspaper, In-Store, Social Media & Digital Media Excluding Regional DataPharmacy Channel: The Main Culprit

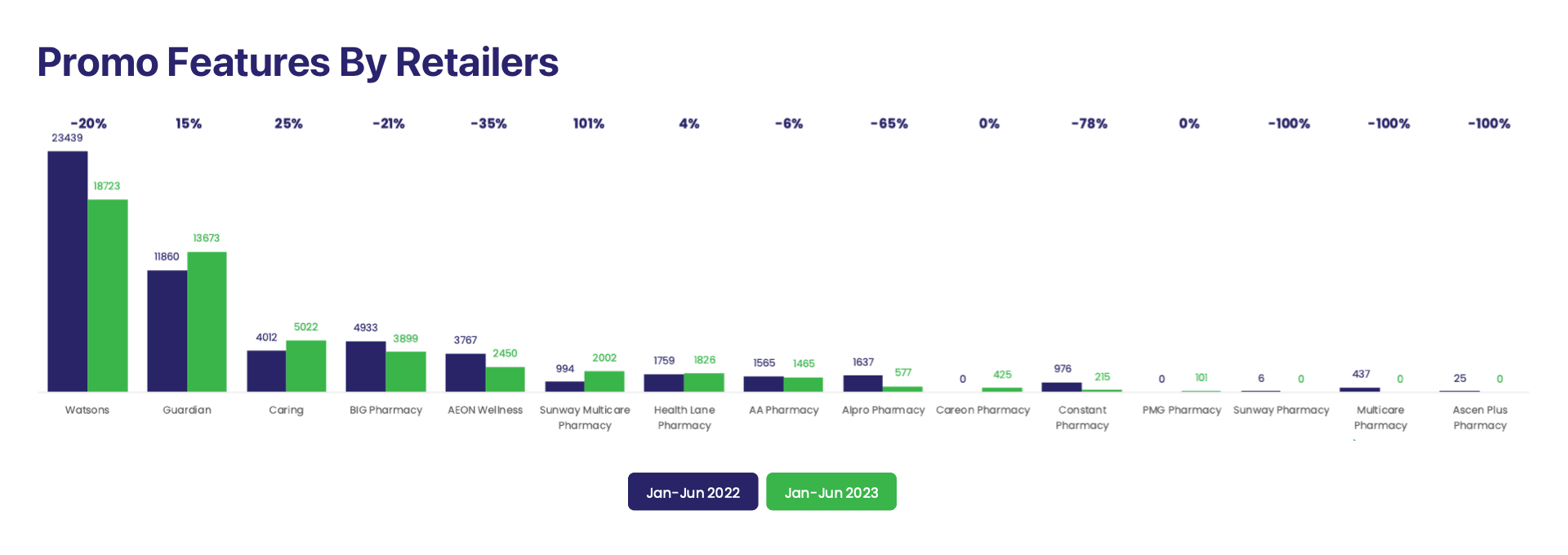

Pharmacy promotions dropped substantially in April, contributing to an overall 9% decrease. Watsons led the pack with a whopping 20% decline in promotional features, accounting for 94% of the overall reduction in the pharmacy channel. This downturn had a domino effect on the Health & Beauty department, which also saw a 9% decline.

Social Media: Not So Social Anymore

While digitalisation is in the air, promotions on social media platforms saw a 7% decline, primarily driven by a 33% reduction in Range Promotions. Watsons and BIG Pharmacy notably reduced their social media range promotions by 39% and 63%, respectively.

The Rise and Rise of Frozen Food and Confectionary

Contrary to the overall trend, Frozen Food promotions surged by 15%, led by QL Figo Foods. The Confectionary sector saw a 17% increase, thanks to Mondelez, Ferrero Asia, and Beryl's Malaysia. Notably, Mondelez outpaced Nestle to become the most promoted supplier in the category.

Hand Wash's Fall from Grace

With the pandemic coming to an end, Hand Wash promotions took a massive hit, declining by 49%. This contributed significantly to the overall decline in the Personal Care category.

Giant's Social Media Triumph

Giant became the retailer with the most promotions, driven solely by a 31% increase in social media features. This is noteworthy considering the overall decline in social media promotions across the board.

Suppliers: The Winners and Losers

Among the top 5 suppliers, Vinda was the outlier with an increase in promotions, mostly in baby products. On the flip side, Unilever saw a 25% decrease, most notably in BIG Pharmacy, where the Simple brand saw a staggering 91% decline.

Basket Price: Your Groceries Just Got Expensive

The basket price increased by 5% compared to last year. Among the Top 30 categories, only Vegetables saw a decline in basket price, while Frozen Food, Noodle, and Asian Drink showed more than a 10% increase.

Analyst Insight

The first half of 2023 has shown that market dynamics in the FMCG sector are more volatile than ever, particularly in the Pharmacy Channel and digital platforms like social media. The steep decline in promotions from major pharmacy retailers like Watsons indicates a strategic shift, possibly driven by a focus on higher-margin products or a reevaluation of the effectiveness of past promotional efforts. This retrenchment in the pharmacy sector had a significant ripple effect, notably impacting the Health & Beauty department. It suggests that pharmacies are becoming more selective in their promotional activities, a trend that could have broader implications for suppliers and for customer loyalty programs.

On the flip side, the substantial increases in promotions for Frozen Food and Confectionary, mainly driven by QL Figo Foods and Mondelez respectively, signify a targeted approach to attract specific customer segments, possibly capitalizing on changing consumer behaviors post-pandemic. The rise in basket prices across nearly all categories, except Vegetables, suggests inflationary pressures that retailers are passing on to consumers. In this environment, the spike in promotions for certain food categories might be a strategic attempt to maintain customer footfall and basket size. The decline in hand wash promotions further underscores the post-pandemic shift in consumer priorities. Given these trends, FMCG companies would do well to re-evaluate their promotional strategies to adapt to these rapidly changing market conditions.

Don't Miss the Full Analysis

Download the complete report and arm yourself with the intelligence you need to stay ahead of the curve.

Don't miss your opportunity to gain a competitive edge.