Malaysia's Retail Sector: An Insightful Analysis of the Booming Pharmacy and Minimarket Channels

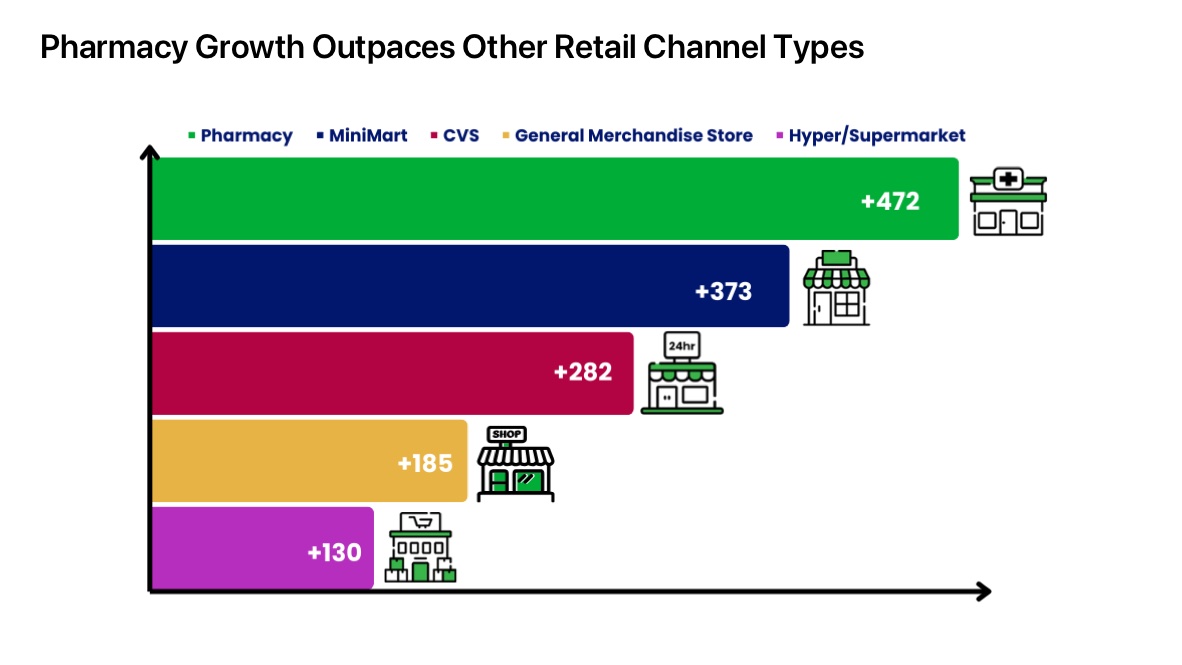

Malaysia witnessed a significant transformation within its retail sector, with pharmacies leading the charge. This sector, alongside minimarkets, has been instrumental in shaping the retail landscape, swiftly adapting to consumer trends and capitalizing on emerging market niches. The growth witnessed in this domain is marked by the entry of new players and the strategic expansion of existing entities.

Pharmacy Channel: Spearheading Retail Growth

Last year, the pharmacy channel saw extraordinary growth, with entities such as PMG Pharmacy, Big Pharmacy, and Alpro Pharmacy expanding their presence markedly. Noteworthy is Alpro Pharmacy's strategic partnership with Sugi Holdings, which heralded the introduction of Japanese-style pharmacies in Malaysia and the broader Southeast Asian region. This collaboration has not only spurred business growth but also introduced unique Japanese health and personal care products to the Malaysian consumer.

Source: MailerTrack

Source: MailerTrackBig Pharmacy's acquisition strategy, notably its merger with Caring Pharmacy, has significantly broadened its customer reach and solidified its position in the market. Its integration of Ting Pharmacy into its network, particularly in Sarawak, reflects an aggressive approach to expansion and a clear intent to secure a dominant market position, challenging established players like Watsons and Guardian.

PMG Pharmacy has also emerged as a significant contributor to the pharmacy channel's success, marking its presence as a key player in the retail analysis for the first time this year.

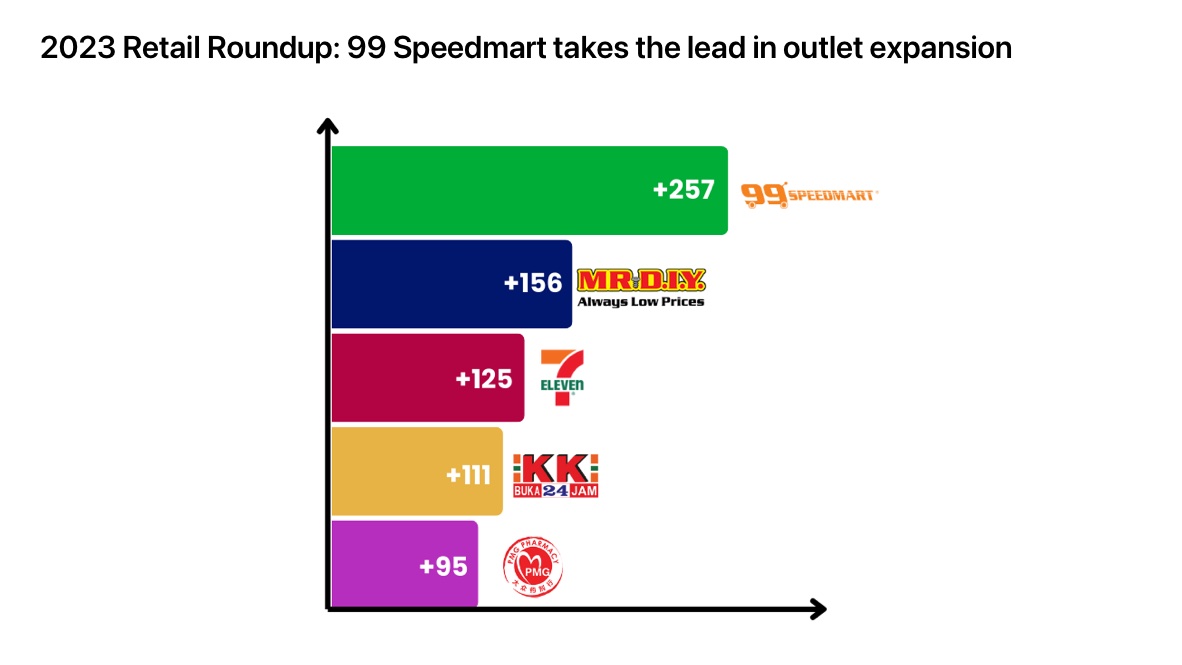

Minimarket Channel: Redefining Convenience Retail

The narrative of growth extends to the minimarket channel, with 99 Speedmart and KK Mart at the forefront. The expansion of these chains, now boasting over 2500 and 750 outlets respectively, has markedly enhanced consumer access and convenience. This surge not only cements the status of minimarkets in the Malaysian retail framework but also highlights the competitive essence of the sector.

Source: MailerTrack

Source: MailerTrackStrategic Focus in Convenience Store (CVS) and Other Channels

Furthermore, Mr. DIY significantly expanded its presence, aligning with its ambitious five-year plan to achieve 2,000 stores by FY28, emphasizing strategic focus on network expansion, revenue optimization, and operational efficiency. 1

In the convenience store (CVS) channel, 7-Eleven's expansion showcased significant growth, particularly driven by the innovative 7-Cafe concept. Plans to open new 7-Cafe stores and refurbish existing ones underscored a strategic shift following the disposal of its equity stake in Caring Pharmacy Group Bhd 2

The market also welcomed novel retail formats, such as Pos Mart convenience stores by POS Malaysia, illustrating channel diversification and innovation.

Challenges and Adaptation

However, Careon Pharmacy witnessed contraction, closing 10 outlets, reflecting the intensely competitive and adaptive nature of the retail landscape.

Strategic Insights and Future Prospects

Overall, 2023 marked a year of strategic expansion and market entry in Malaysia's retail channel, driven by adaptation to changing consumer preferences and dedication to improving customer convenience and access. The pronounced growth in the pharmacy channel highlighted an increasing focus on health and wellness, promising continued influence on the retail landscape in future years. These developments offer valuable insights for professionals and businesses in the retail industry, emphasizing the importance of agility and strategic foresight in navigating the fiercely competitive market environment.

Don't Miss the Full Analysis

Download the complete report and arm yourself with the intelligence you need to stay ahead of the curve.

Don't miss your opportunity to gain a competitive edge.